Finance App Development in Canada

Empowering Canada’s financial sector with AI-powered, regulation-compliant mobile app solutions tailored for the Canadian market. Banao Technologies specializes in scalable fintech development, offering features like smart expense tracking, real-time KYC, digital wallets, and secure payment gateways. Our finance apps combine modern UI/UX, OSFI/FINTRAC/PIPEDA compliance, and enterprise-grade security to deliver seamless, future-ready user experiences for banks, fintechs, and startups.

Unlock Scalable & Compliant Financial Solutions with Banao Technologies

Whether it's digital wallets, investment platforms, or banking apps, Banao creates personalized fintech solutions that meet the unique needs of each client. We go beyond off-the-shelf products to deliver robust, regulatory-ready solutions designed to grow with your business. Banao Technologies excels in building user-centric, scalable mobile and web apps tailored for the finance industry. Our expertise helps financial institutions in Canada offer secure, modern, and regulation-compliant digital experiences.

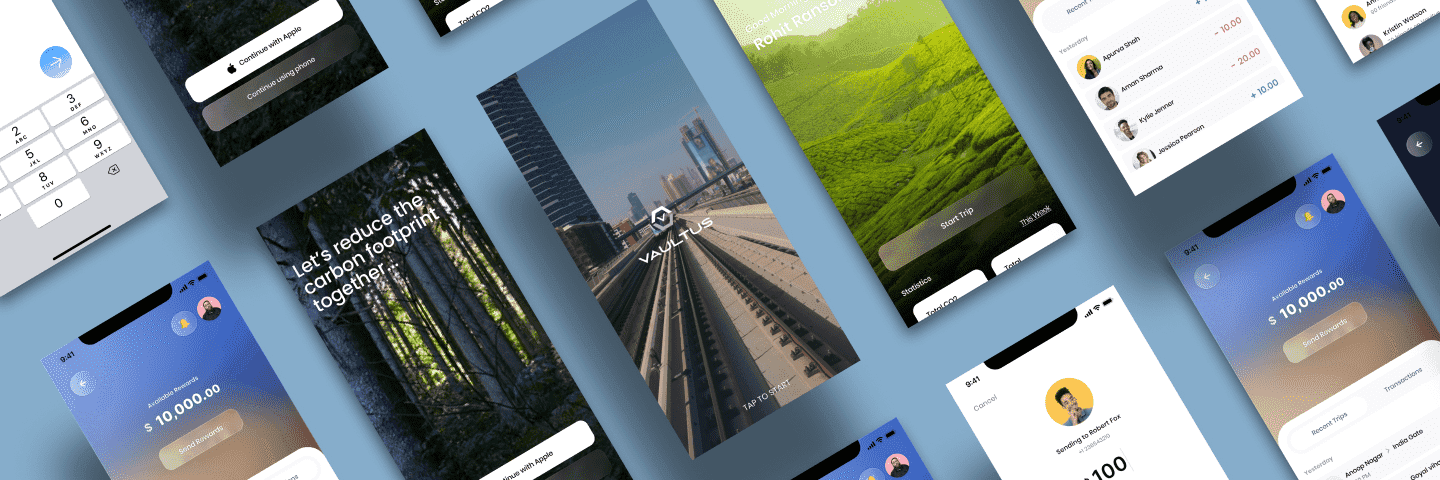

Finance App Development That Engages and Converts

At Banao Technologies, we don’t just build finance apps — we deliver intuitive, real-time platforms that keep users engaged and returning. Our solutions empower businesses in Canada to create seamless digital ecosystems for financial services, combining UX excellence with OSFI/FINTRAC/PIPEDA-compliant security and innovation.

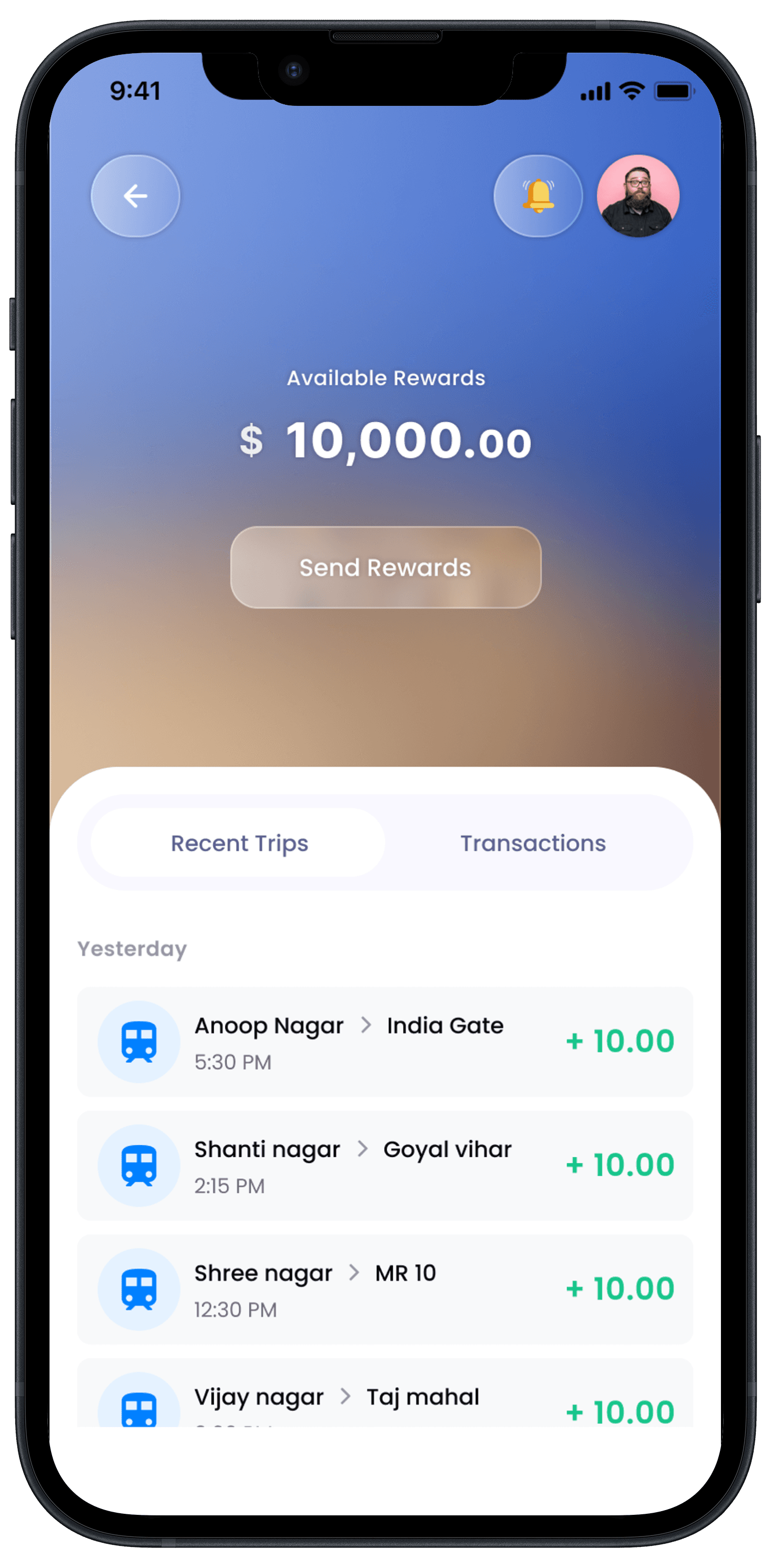

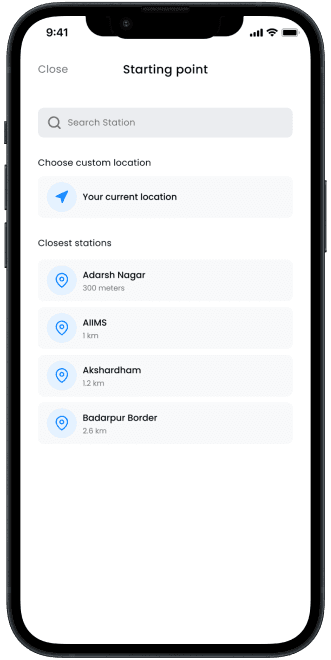

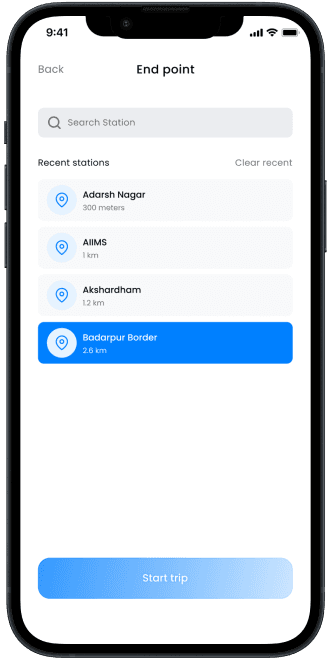

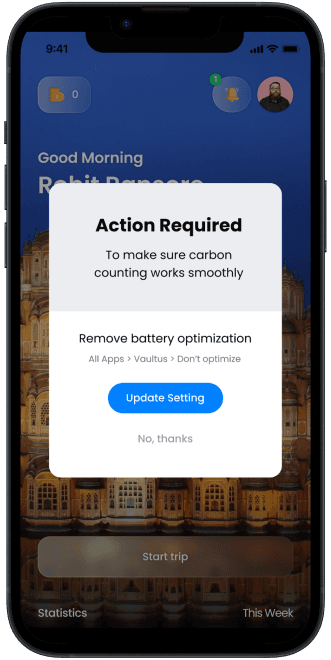

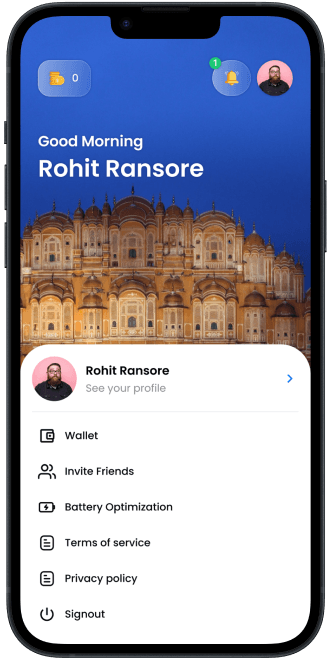

Personalized Financial Management

Deliver hyper-personalized experiences with our finance apps. We design custom dashboards, AI-driven insights, and tailored features that meet the unique financial habits of your users — whether they're investors, consumers, or business clients.

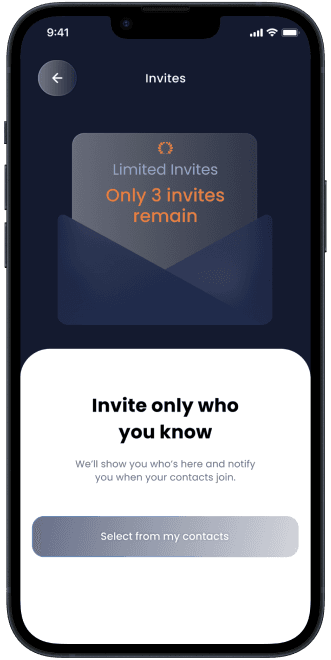

Seamless Digital KYC

Accelerate onboarding with our fully digital KYC solution, built to meet Canadian compliance requirements. Users can verify identities from anywhere with ease — reducing drop-offs and increasing conversions while staying regulatory-ready.

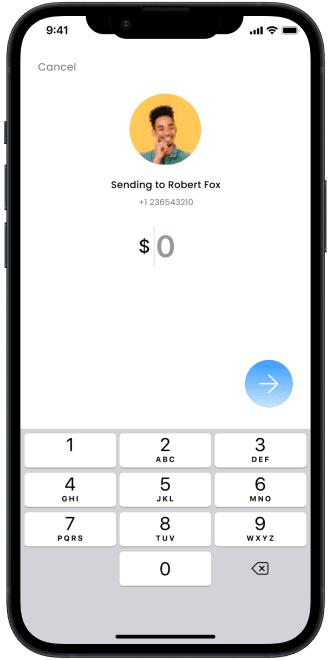

Instant Bill Payments

Streamline utility, telecom, and service payments with Banao’s secure bill-pay integrations. Our apps offer frictionless transactions through trusted Canadian payment gateways (such as Interac, Moneris) and global providers, making payments quick, safe, and accessible on-the-go.

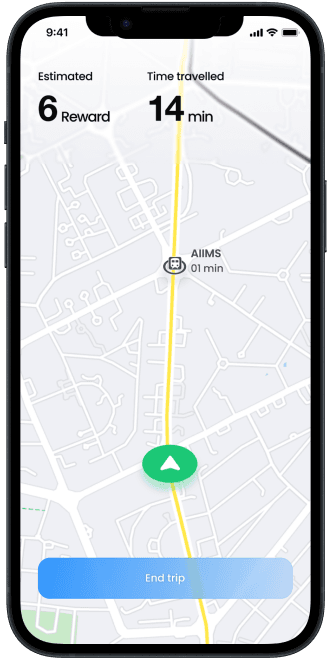

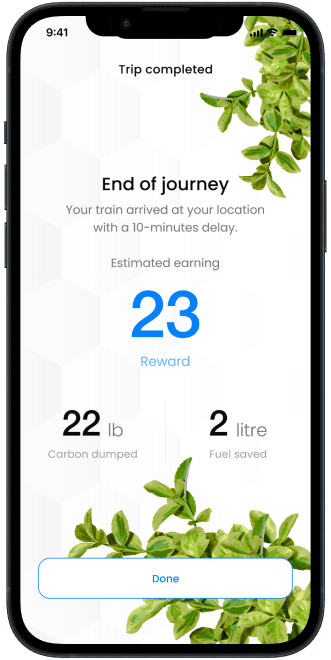

Intelligent Expense Tracking

Empower your users to take control of their finances with smart budgeting tools. Our apps analyze spending patterns and provide proactive suggestions to improve savings, spending, and financial literacy.

Trusted Industry Leadership

Recognized across India and now extending to Canada, Banao is a top-tier fintech development partner. We bring award-winning design, agile development, and scalable architecture to every finance project we undertake.

Why Choose Banao Technologies for Your Finance App Development in Canada?

Banao Technologies is your trusted fintech partner for building scalable, secure, and compliant finance applications. Our expertise spans OSFI/FINTRAC/PIPEDA-compliant architecture, real-time financial services, and high-performing mobile experiences. With a focus on data integrity, personalization, and continuous innovation, we empower Canadian businesses to launch and scale future-ready financial platforms with confidence.

Revolutionize Your Users' Financial Experience with Our Fintech Solutions

At Banao Technologies, we go beyond standard app development — we deliver immersive, real-time finance experiences that keep users engaged and returning. Our custom finance apps empower Canadian businesses to build dynamic digital ecosystems where users can access, manage, and grow their financial journeys seamlessly. From smart banking to investment tools, we help you drive deeper customer engagement and long-term trust.

Begin Your Digital Finance Transformation

Our Proven Finance App Development Process

Discovery & Strategy

We begin with in-depth market research and competitor benchmarking, tailored for Canada’s financial sector. By understanding your Canadian audience, local regulatory requirements (including OSFI, FINTRAC, PIPEDA), and business goals, we craft a clear roadmap for a compliant, innovative fintech app.

UI/UX Design for Fintech

Our finance-focused design team creates intuitive, accessible, and visually engaging interfaces that enhance user trust and usability. With a deep understanding of Canadian digital behaviour and bilingual (English/French) needs, we deliver experiences that simplify complexity and drive engagement across mobile and web platforms.

Agile Development & Testing

We leverage agile methodologies and robust web technologies to build scalable, secure financial apps. Frequent updates, modular sprints, and real-time reviews ensure transparency and precision. Our unit testing guarantees stability and reliability from the ground up.

Comprehensive Quality Assurance

Every financial solution is tested by our expert QA engineers for performance, security, and compliance. We conduct rigorous manual and automated testing within CI/CD pipelines to ensure your product delivers a flawless and secure user experience.

Seamless Deployment

Our CI/CD pipelines ensure seamless product rollouts to production environments. With real-time monitoring and automated alerts, we guarantee 99.9% uptime and reliability — essential for always-on financial platforms in Canada.

Ongoing Support & Maintenance

We provide 24/7 technical support and maintenance tailored to financial systems. From security patching and feature updates to server optimization and performance audits, we ensure your app stays compliant, fast, and scalable at all times.

See what clients say about us...

Shaurya Malhotra

Founder, Ether

Rachiket Arya

Co-founder and CTO, Jackett

Vikash Srivastava

Co-founder and CTO, Almabetter

Have no regrets about working with Banao!

Ether is a social network app, which came to life after working with Banao. The support provided on development was exceptional and Sourav, the developer, was extremely helpful in understanding requirements and suggesting better options.

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently Asked Questions

How does Banao Technologies ensure top-tier security in finance app development?

At Banao Technologies, security is our top priority. We integrate industry-standard encryption, secure login protocols, and multi-factor authentication to protect sensitive financial data. Regular security audits and compliance with Canadian (OSFI, FINTRAC, PIPEDA) regulations further enhance app integrity and data privacy.

What sets Banao Technologies apart in building finance apps for the Canadian market?

Our team combines deep fintech domain knowledge with a regional understanding of Canada’s finance regulations and user expectations. This enables us to deliver highly customized and compliant solutions tailored specifically for Canadian financial enterprises.

Do you offer custom features for different finance business models?

Yes, we specialize in tailoring finance apps to meet the specific needs of each business. Whether you're building a lending platform, digital wallet, or expense tracker, our flexible development approach ensures every feature aligns with your business goals and audience needs.

How do you create a smooth and intuitive user experience in your finance apps?

We follow a user-first design approach, focusing on intuitive navigation, minimalistic design, and responsive layouts. Our UI/UX experts use real user feedback and the latest design trends to create seamless digital journeys across all devices.

What kind of support can I expect after the finance app is launched?

Post-launch, our dedicated support team ensures your app stays up-to-date, secure, and scalable. We provide performance monitoring, security updates, feature enhancements, and prompt issue resolution to ensure business continuity and optimal user satisfaction.

Do you offer AI integration in finance app development?

Absolutely. Banao Technologies integrates AI to enhance user personalization, automate fraud detection, improve financial forecasting, and provide smart expense tracking. By leveraging machine learning and predictive analytics, we help finance apps become more intuitive, secure, and efficient.