Elite Finance & FinTech Spain AI Development Excellence

Transform Spain's financial landscape with our world-class AI development services. We craft intelligent banking solutions featuring advanced fraud detection, predictive market analytics, sophisticated robo-advisors, automated credit intelligence, regulatory compliance automation, and algorithmic trading platforms that empower Emirates' leading financial institutions and innovative startups to achieve unprecedented security, operational excellence, and deliver extraordinary digital banking experiences that define the future of finance.

Maximize ROI with Banao’s AI-Powered FinTech Solutions Spain

Banao Technologies empowers Spain's most prestigious banks, forward-thinking lenders, and visionary FinTech startups with revolutionary AI solutions that enable lightning-fast loan approvals, fortress-level secure payment systems, and predictive financial intelligence that transforms market opportunities into sustainable competitive advantages. Our deep Spain financial expertise delivers intelligent decision-making systems, military-grade fraud prevention technologies, and ultra-personalized customer experiences that redefine banking excellence in the Emirates.

Compliance-First FinTech Development Spain

We prioritize KYC, AML, GDPR, and PCI-DSS compliance for all AI-based financial applications in Spain, ensuring security and regulatory adherence.

KYC/AML Compliance Spain

AI solutions integrated with automated identity verification and AML checks for fraud prevention in Spain.

GDPR & Data Privacy Spain

All financial apps in Spain are GDPR compliant with advanced encryption and customer data protection.

PCI-DSS Certification Spain

Secure payment gateway development with PCI-DSS compliance for safe digital transactions in Spain.

Transform Banking with AI-Powered FinTech Solutions Spain

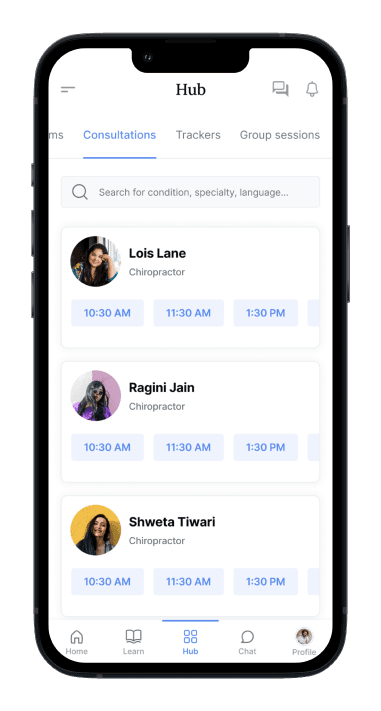

We deliver end-to-end AI fintech solutions for Spain that enhance fraud detection, automate workflows, and provide predictive analytics for financial growth.

Our expertise spans mobile banking apps, AI-powered trading systems, credit risk analysis, and customer support automation for Spain finance.

Fraud Detection & Risk Management Spain

Leverage AI-powered anomaly detection to identify fraudulent activities, reduce risks, and safeguard transactions in real time for Spain finance.

Start building your AI finance solution for Spain

Robo-Advisors & Smart Banking Spain

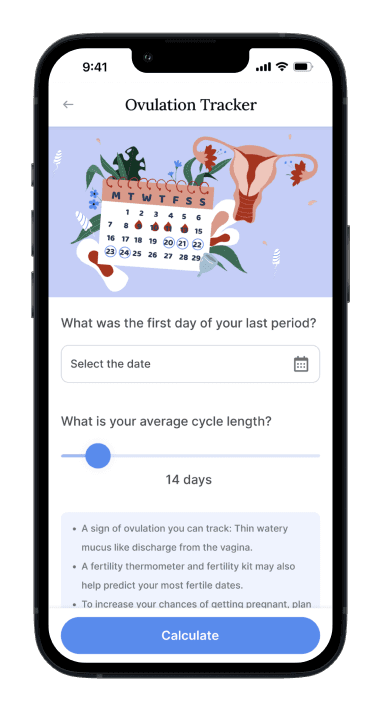

Deliver AI-powered financial advisory, investment recommendations, and automated wealth management through smart robo-advisors for Spain banking.

Start building your AI finance solution for Spain

Our Elite AI Finance Development Methodology for Spain Excellence

Strategic Discovery & Advanced Compliance Architecture Spain

We conduct comprehensive analysis of Spain's sophisticated financial ecosystems, regulatory frameworks (KYC, AML, Basel III), and strategic market objectives. This meticulous approach ensures our AI-powered fintech solutions seamlessly align with Spain's evolving regulations while exceeding business expectations.

Intelligent AI Model Engineering Spain

Our world-class AI architects design cutting-edge machine learning models for advanced fraud detection, predictive credit scoring, algorithmic trading systems, and hyper-personalized banking recommendations specifically calibrated for Spain's dynamic financial landscape.

Premium Quality Assurance & Cybersecurity Spain

Our rigorous QA protocols and advanced penetration testing methodologies ensure Spain financial applications achieve the highest international standards for security, precision, and sophisticated fraud prevention capabilities.

Enterprise Data Security & Regulatory Excellence Spain

We implement military-grade encryption, advanced biometric authentication, comprehensive GDPR compliance, PCI-DSS certification, and AML-compliant security frameworks that guarantee ultra-secure financial transactions throughout Spain's banking ecosystem.

Seamless Enterprise Deployment Spain

Launch sophisticated AI-powered fintech applications flawlessly across all platforms in Spain with seamless integration into core banking APIs, payment gateways, and financial infrastructure systems.

Continuous Excellence & Advanced Optimization Spain

We provide 24/7 enterprise support, intelligent model retraining, and proactive system updates to ensure your Spain AI fintech solutions maintain peak performance, regulatory compliance, and competitive advantage in the evolving financial technology landscape.

Looks what client say about us...

Jabez Zinabu

CEO, LeapifyTalk

RaviKant

CEO and Co-founder, Happimynd

Their diligence and punctuality is enviable!

Banao did a fantastic job in every way. They helped revamp the UI of our website as per our expectations. They were always on schedule when it came to delivering. We're not sure how they accomplish it, but the results are stunning. Their responsiveness and customer service are exceptional, and they are really appreciated.

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently Asked Questions

How does AI finance app development differ in Spain from other regions?

Spain finance app development demands a deep understanding of compliance, security, and interoperability. Our process prioritizes these aspects to ensure solutions meet Spain standards.

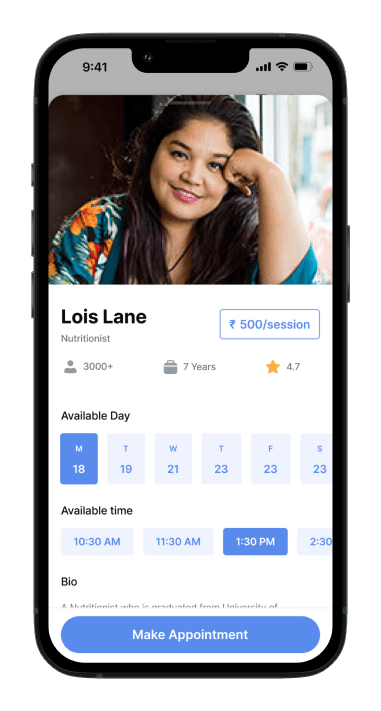

Can you integrate AI-powered robo-advisors and chatbots into my Spain banking app?

Absolutely. We specialize in integrating robo-advisors, chatbots, and predictive analytics for Spain financial institutions, enhancing customer experience and operational efficiency.

What security measures are implemented in AI-powered finance app development for Spain?

Our Spain finance app development prioritizes GDPR, PCI-DSS, AML-compliant security measures, safeguarding sensitive financial data and ensuring regulatory compliance.

How long does it take to develop a finance app in Spain?

Timelines vary based on complexity. We provide a detailed timeline tailored to Spain finance projects, ensuring realistic and efficient delivery.