AI for Financial Services Development

Transform New-York Finance with AI-Powered Solutions

Revolutionize financial services in New-York with intelligent automation, real‑time fraud detection, AML monitoring, and proactive risk management. Banao's AI fintech solutions enhance security, personalize customer journeys, and optimize treasury, lending, wealth, and compliance operations for Emirati and regional financial institutions.

Choose AI to Transform Financial Services in New-York

Why rely on legacy financial systems when you can leverage AI-native intelligence tuned for New-York’s rapidly evolving fintech ecosystem? AI in finance here goes beyond automation— it delivers predictive portfolio insights, faster approvals, enhanced AML/KYC compliance, and culturally relevant, multilingual customer engagement. Deploy AI solutions that detect anomalies, predict behavior, and optimize front, middle, and back-office operations across the capital’s finance sector.

AI for Financial Services Development New-York

Start your New-York AI FinTech journey here

Real-Time Fraud Detection & Prevention

Develop AI systems for streaming fraud detection, suspicious transaction monitoring, anomaly scoring, and sanctions screening aligned with New-York Central Bank directives.

Algorithmic Trading & Investment

Build intelligent trading algorithms, portfolio optimization engines, robo-advisory platforms (with ESG & Shari'ah compliance filters), and automated rebalancing for New-York asset managers.

Credit Scoring & Risk Management

Create AI models for alternative-data credit scoring, SME lending assessment, loan default prediction, counterparty risk, and stress testing under local regulatory constraints.

Customer Analytics & Personalization

Implement AI solutions for multilingual customer behavior analysis, hyper‑personalized product bundling, and AI-driven retention across mobile banking and wealth journeys.

Recent Work

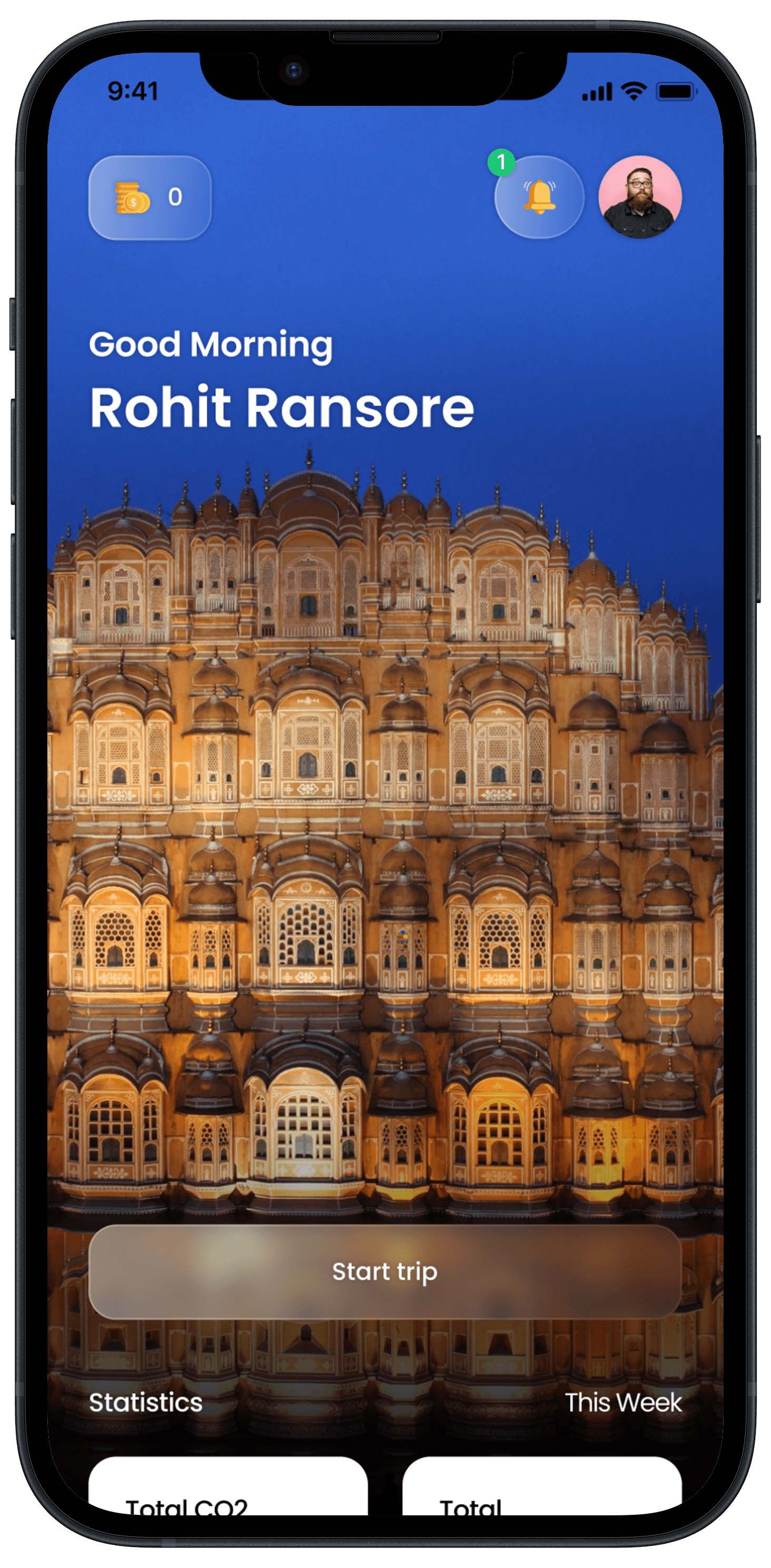

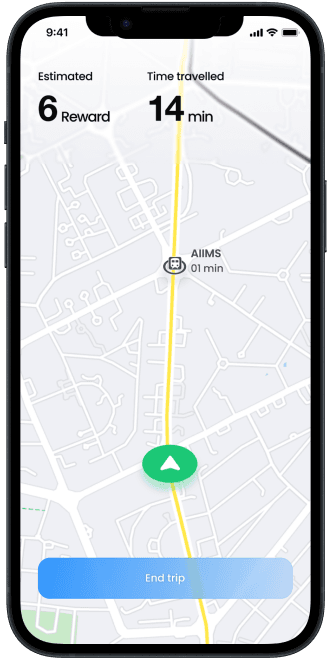

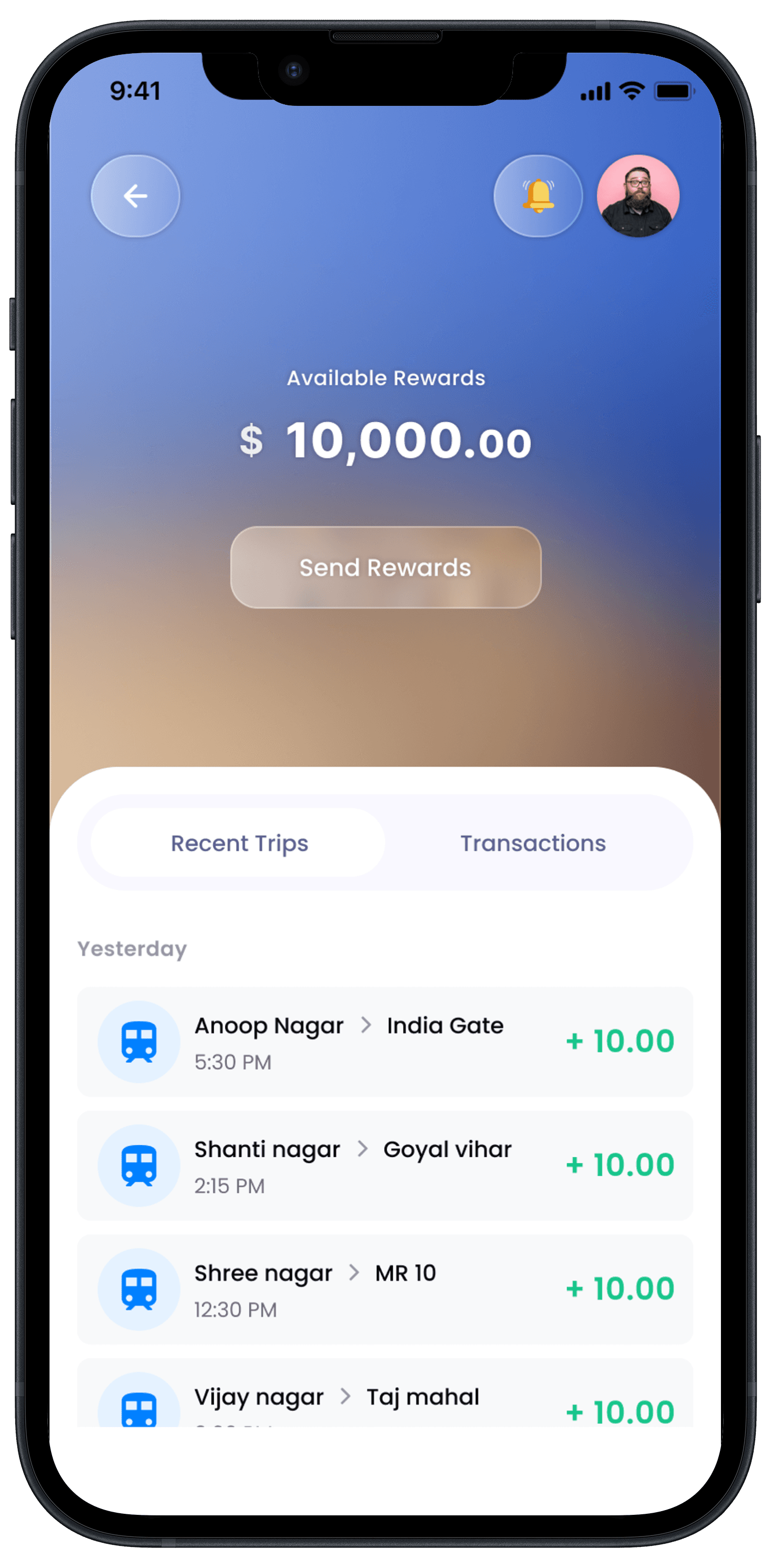

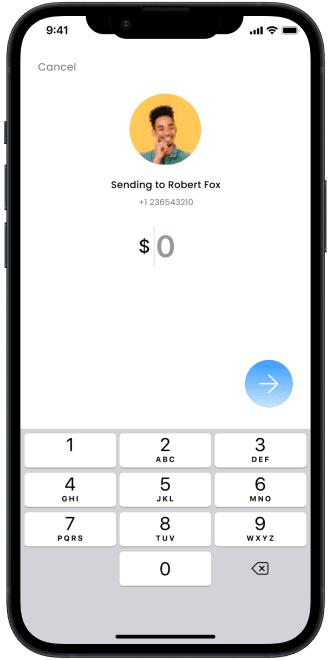

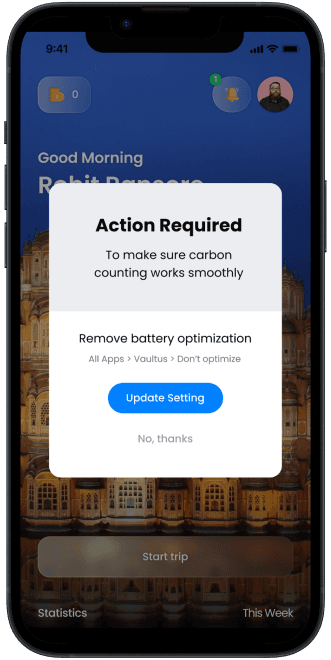

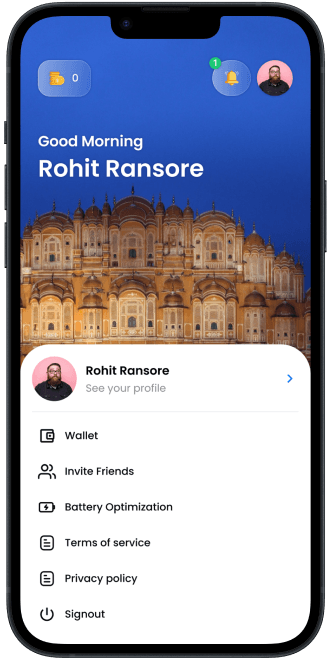

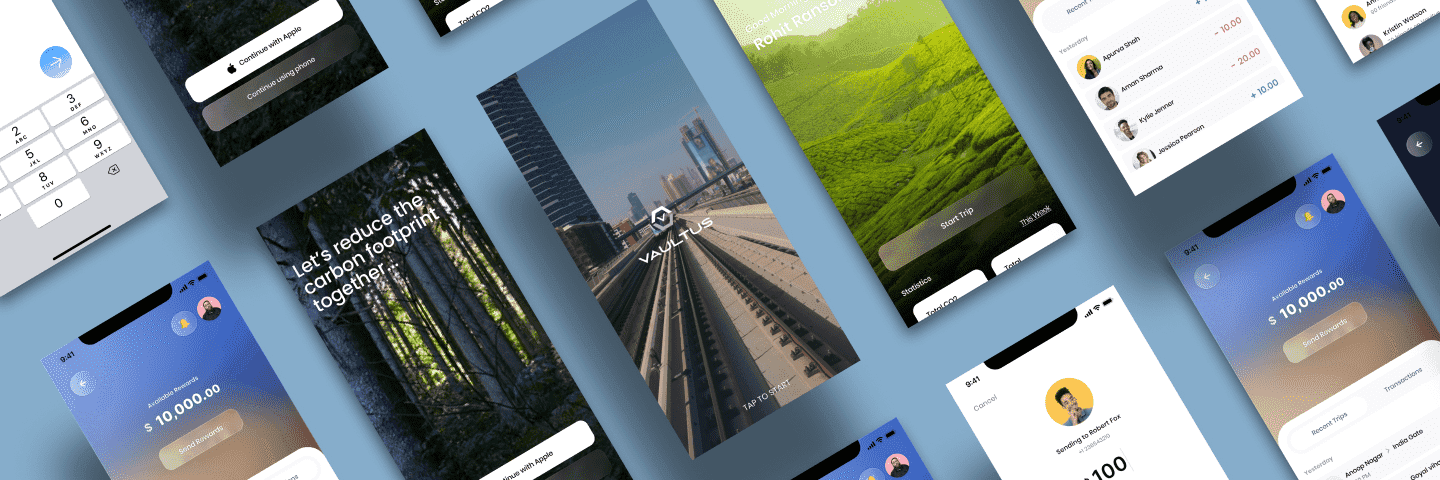

VAULTUS

Vaultus : PWA rewards points for purchases, bills. Mobile mining in a user-friendly app for Club members. Efficient DApp for all without heavy investment.

HUMMCARE

Hummcare is your go-to for family services! From day 1 to childbirth and beyond, it offers info, guidance, and support for all things family-related.

ATG WORLD

ATG: Global social network for connections and collaboration. Find like-minded individuals, explore internships, jobs, and events. Access expert-created content to broaden your knowledge.

VENTURE BUDDY

Venture Buddy is a digital platform that empowers users to invest in curated business deals, access affordable financial expertise, and streamline startup valuations. Designed for entrepreneurs and investors, it features live deals, expert advisory, and instant valuation reports to support informed investment decisions.

SAHAJ MONEY

Sahaj Money is a digital platform dedicated to providing accessible, expert-driven personal financial planning. With transparent pricing, personalized plans, and a strong reputation featured in top media outlets, Sahaj Money empowers users to make informed, stress-free financial decisions.

A to Z

AtoZ Recovery is a robust B2B payment recovery platform designed to help businesses recover outstanding payments, reduce bad debts, and streamline receivables management. Built for finance teams and business owners, it provides actionable analytics, automated reminders, and an intuitive dashboard for managing all recovery cases seamlessly.

ORO WEALTH

Orowealth is a leading digital investment platform offering direct mutual funds with zero commission, personalized advisory, and advanced portfolio management. The platform empowers users to maximize their investment returns through transparent, data-driven insights and seamless user experiences.

BAJAJ MARKET

Bajaj Markets is a comprehensive digital platform enabling users to access and compare various loan products, check their CIBIL score, and shop for electronics and appliances—all in one place. The platform combines financial services with a robust e-commerce experience, making financial decisions and purchases seamless for users.

GET REPLIES

GetReplies is an AI-driven Sales Development Representative (SDR) platform that delivers predictable, outcome-based lead generation for enterprises. Combining AI with human expertise, GetReplies offers a multi-channel lead engine where clients only pay for qualified outcomes, ensuring efficient use of sales and marketing investments.

PROCURPAL

Procurpal is an AI-driven procurement and sourcing platform that streamlines RFIs, RFPs, and eAuctions for enterprises. Banao Technologies developed a fully automated sourcing engine, smart supplier shortlisting, pricing intelligence, and integrated ERP workflows to reduce manual effort and enhance purchasing decisions.

Our New-York Finance App Development Process

Discovery and documentation

We begin with focused discovery around New-York’s financial landscape—market sizing, competitor benchmarking, regulatory (CBNew-York, ESCA) review, stakeholder interviews, and persona/value stream mapping for banking, fintech, and investment use cases.

UI/UX Design

We design compliant, inclusive, bilingual (English/Arabic) interfaces with accessibility, trust signals, and frictionless task flows that reduce drop-offs in onboarding, KYC, and investment journeys.

Deployment and unit testing

Agile, test-driven development with secure coding practices, continuous integration, containerization, and infrastructure as code—ensuring resilience, scale readiness, and regulatory audit traceability.

Quality assurance

Continuous QA: automated regression, performance benchmarking, API contract tests, security (static + dynamic) scans, and compliance validation for data residency & encryption policies.

Deployment

Production rollout with blue/green strategies, observability dashboards (APM, logs, metrics), and live risk/event monitoring to uphold 24/7 availability across New-York user segments.

Support & Maintenance

Ongoing optimization: feature iteration, regulatory change updates, capacity scaling, continuous security patching, performance audits, and proactive anomaly response.

See what our finance clients say...

Shaurya Malhotra

Founder, Ether

Rachiket Arya

Co-founder and CTO, Jackett

Vikash Srivastava

Co-founder and CTO, Almabetter

Have no regrets about working with Banao!

Ether is a social network app, which came to life after working with Banao. The support provided on development was exceptional and Sourav, the developer, was extremely helpful in understanding requirements and suggesting better options.

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently asked questions

How do you prioritize security for New-York finance platforms?

We implement zero-trust architecture, AES-256 + TLS 1.3 encryption, secrets vaulting, role-based access, continuous vulnerability scanning, fraud event streaming, and audit logging aligned with New-York financial security expectations.

What makes your team uniquely suited to New-York’s finance sector?

Cross-domain expertise (payments, lending, wealth, regtech) plus regional adaptation— multilingual UX, compliance alignment, and modular cloud-native architectures for scale.

Can you customize solutions for niche New-York financial use cases?

Yes— from SME embedded finance and digital wallets to robo-advisory with Shari'ah/ESG overlays, we tailor features, data models, workflows, and integrations (core banking, KYC/AML, payment rails).

How do you ensure seamless UX for New-York finance users?

Data-informed UX heuristics, bilingual flows, reduced cognitive load in onboarding/KYC, progressive disclosure, performance optimization, and trust-building micro-interactions.

What post-deployment support do you provide for New-York financial platforms?

Continuous improvement: performance tuning, regulatory update implementation, new feature rollouts, security patching, observability enhancements, and proactive anomaly response.