Overview

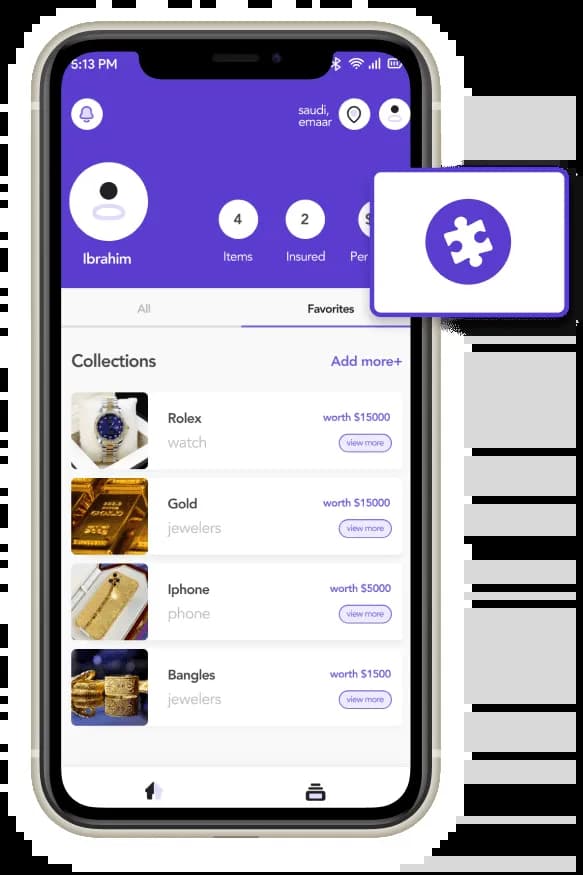

Banao Technologies collaborated with Rodi to create an AI-powered insurance platform that enables agents and users to secure valuable items through real-time monitoring and seamless insurance integration. The solution bridges the gap between safety and technology, providing smart coverage, instant alerts, and automated claims processing — all within a single mobile app.

Industry

SAASBusiness type

AI-Powered Insurance Solution for Agents & Users

Build your idea

Consult our expertsImpact After Launch

Rodi revolutionized the insurance experience by combining AI automation with security intelligence. Users can now insure, track, and monitor their belongings in real time, receive safety alerts for their travel locations, and process claims faster than ever before — resulting in a safer, more transparent insurance ecosystem.

Key results achieved after deployment

0+

automated claim verifications through AI,

0+

real-time security alerts delivered to users, and

0%

reduction in theft and loss risk for insured valuables.

Challenge

Developing a unified insurance and security platform required integrating multiple third-party insurance APIs, building reliable real-time incident tracking, and ensuring compliance with strict data security and verification standards.

Our Solution

Banao Technologies engineered a scalable AI-powered platform combining real-time geolocation monitoring, AI-driven claim automation, and secure KYC verification. Using Node.js, FastAPI, and OpenCV, we created an intelligent system that alerts users about incidents, verifies claims, and ensures data privacy through layered authentication.

Features Implemented:

- AI-powered real-time travel alerts and risk detection

- Automated claims processing with fraud detection

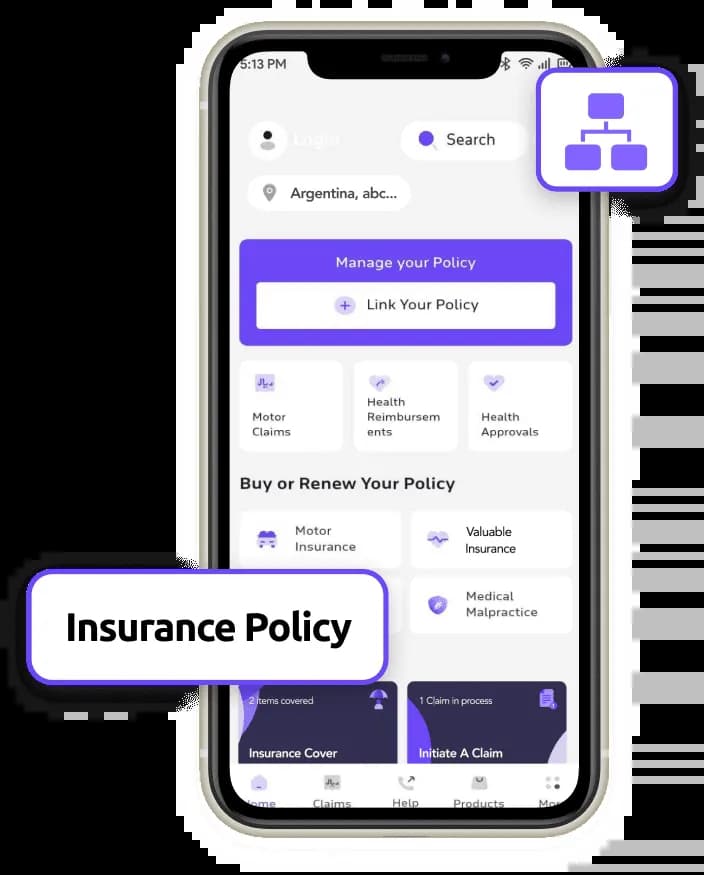

- Seamless integration with multiple insurance providers

- Advanced security using KYC and Liveness Detection

Key Features Implemented

An intelligent AI insurance system that combines policy management, real-time alerts, and claim automation — ensuring security, efficiency, and trust for both users and agents.

AI-Driven Incident Reporting

Allows users to report theft or incidents directly from the app, helping build a community-driven security network.

Real-Time Location Monitoring

Tracks travel destinations and sends security alerts for incidents or risks in selected areas.

AI Automation for Insurance Claims

Automates claims verification, reducing manual intervention and speeding up approval times.

Secure KYC & Liveness Detection

Protects user identity and ensures only verified users can access sensitive data or insurance details.

Where we're located

Frequently Asked Questions

What is Rodi AI?

Rodi is an AI-powered insurance solution that allows users to insure, monitor, and manage their valuable belongings through a secure, real-time digital platform.

How does AI enhance the insurance process?

AI automates claim verification, fraud detection, and security alerts — improving efficiency and reducing risks for both users and insurance providers.

Can Rodi integrate with multiple insurance companies?

Yes, Rodi seamlessly integrates with multiple insurance APIs, enabling users to connect their policies from various providers in one unified dashboard.

What security features does Rodi offer?

Rodi implements KYC verification, Liveness Detection, and JWT-based authentication to ensure data protection and regulatory compliance.