Aussie Finance Banking, Payments & Fintech—Reimagined

From neobanks to credit unions, Banao powers Australia’s finance sector with secure, flexible platforms that put customers first and compliance on autopilot.

Why Choose Banao for Finance in Australia?

Our platforms deliver reliability, speed, and security—enabling new revenue streams and exceptional customer experiences across Australia. We blend deep fintech expertise with local regulatory know-how, building future-proof systems for banks, lenders, and digital disruptors.

Finance Security & Compliance, Built for Australia

Every solution meets APRA, ASIC, and AUSTRAC requirements. Privacy, PSD2, and Open Banking are built in from day one.

Real-Time Fraud Detection

AI-driven monitoring and alerts for suspicious activity—protecting every transaction.

PCI DSS & ISO 27001 Compliance

Payments and data storage align with top security standards and Australian regulations.

Open Banking API Integration

Connect with Australia’s Open Banking ecosystem for streamlined account access and aggregation.

Automated Regulatory Reporting

Instantly generate compliance reports for APRA, ASIC, and AUSTRAC.

Biometric & MFA Authentication

Enable FaceID, fingerprint, and two-factor login for ultimate customer protection.

Accessibility & Inclusivity

WCAG-compliant interfaces and multi-language support for every Australian customer.

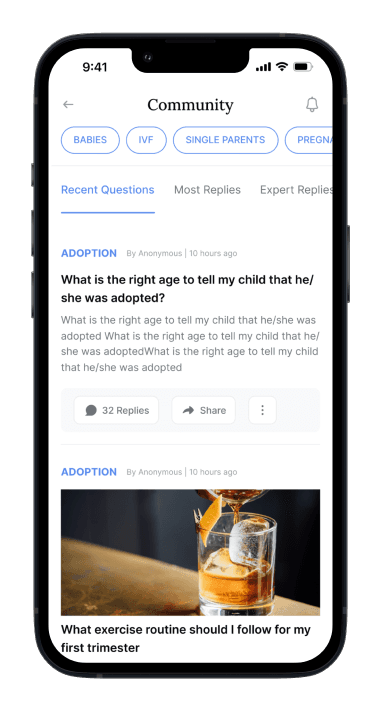

From Traditional Banking to Fintech, We Power It All

Modern Finance Solutions for Australia

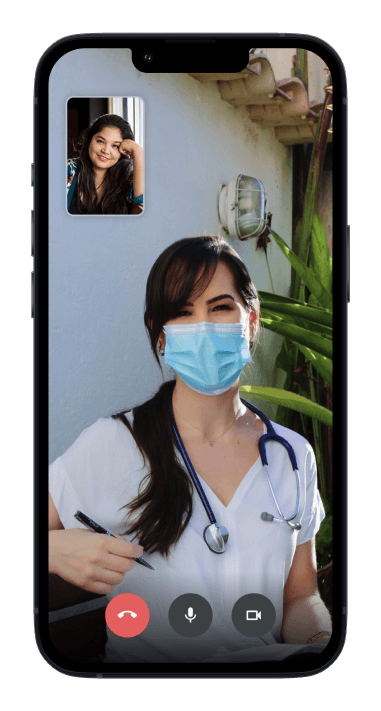

Digital-First Customer Experience

Instant onboarding, live chat, and smart notifications drive engagement and loyalty.

API-Ready for Ecosystem Growth

Easily connect with partners, apps, and fintech marketplaces—futureproofing your business.

Banking & Payments Excellence

Offer full-featured digital banking, instant payments, and account management—across mobile, web, and branch.

Launch Your Finance Transformation

Lending, Wealth & Analytics

Automate loan origination, wealth management, and regulatory reporting—all in one platform.

Smarter Decisions, Better Outcomes

How We Build Finance Platforms for Australia

Discovery & Compliance Analysis

We map your institution’s regulatory, integration, and user experience needs—ensuring every workflow fits APRA, ASIC, and Australian privacy law.

Payments, Lending & Open Banking Integration

We develop real-time payments, loan origination, and Open Banking modules—making Aussie finance more flexible and accessible.

Security-First Development

From penetration testing to encrypted data lakes, we prioritise trust and resilience at every stage.

Ongoing Auditing & Regulatory Reporting

Automate compliance with AUSTRAC, APRA, and ASIC—making audits and reporting stress-free.

Customer Rollout & Partner Integrations

Rapid deployment with integration to Australian payment rails, banks, credit bureaus, and core banking systems.

Continuous Upgrades & Support

Banao delivers updates for new payments standards, cyber threats, and market trends—keeping you ahead of the curve.

Aussie Fintech Success

Jabez Zinabu

COO, GreenBank AU

RaviKant

Founder, Fintech Next

Regulatory peace of mind!

Banao’s compliance automation and fast support made our digital transformation a breeze—no more audit stress.

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently Asked Questions

What’s unique about finance tech in Australia?

Local compliance, Open Banking, and customer protection are non-negotiable. Our platforms are designed for the real needs of Aussie finance.

Do you support digital wallets and mobile payments?

Yes, we integrate Apple Pay, Google Pay, and all local payment standards.

Can you automate AUSTRAC and APRA reporting?

Absolutely—save time and reduce errors with automated, audit-ready compliance tools.

Is ongoing support included?

Yes—our Sydney/Melbourne-based team is available for updates, patches, and urgent support.