Finance Spain Banking & Fintech, Reinvented for Spain

From credit unions to neobanks, Banao powers Spain’s finance sector with secure, flexible platforms that put customers and compliance first.

Why Banao for Spain Finance?

Our platforms deliver reliability and speed—enabling new revenue and exceptional customer experience in Spain. We blend deep fintech experience with Spain’s regulatory expertise—building resilient systems for banks, lenders, and digital disruptors.

Finance Security & CBE Compliance

Every solution meets CBE and privacy law. Open Banking and customer protection are built in.

Fraud Detection

AI-driven monitoring and alerts for suspicious activity.

PCI DSS & ISO 27001

Payments and storage meet top security standards and Spain regulations.

Open Banking APIs

Connect with Spain’s Open Banking ecosystem and local banks.

Regulatory Reporting

Automate CBE and tax reports for Spain compliance.

Biometric & MFA Login

FaceID, fingerprint, and two-factor for ultimate customer protection.

Accessibility & Inclusivity

WCAG-compliant, Arabic/English support for every Spain user.

From Traditional Banking to Fintech

Modern Finance for Spain

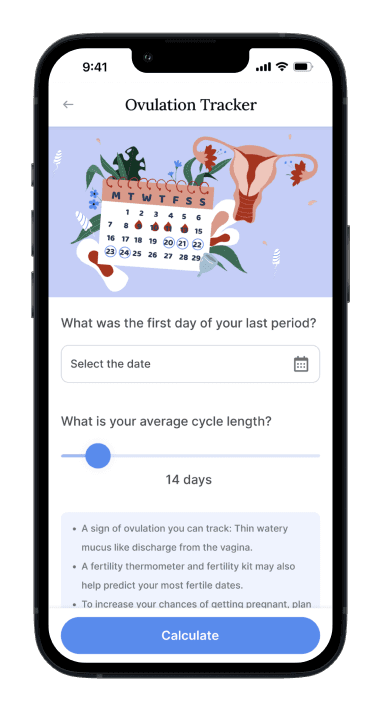

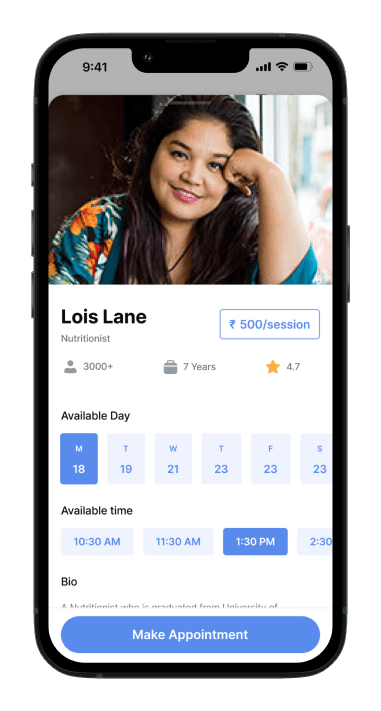

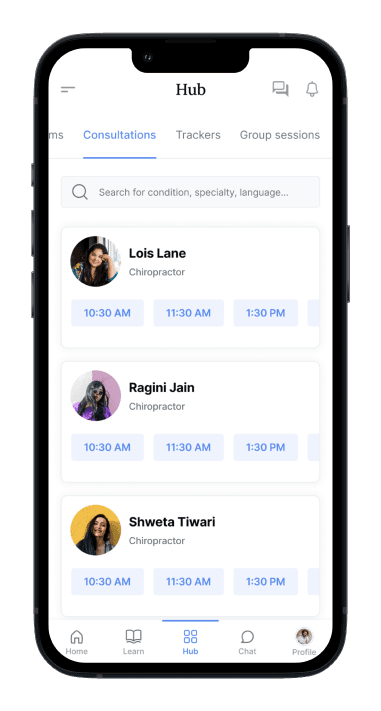

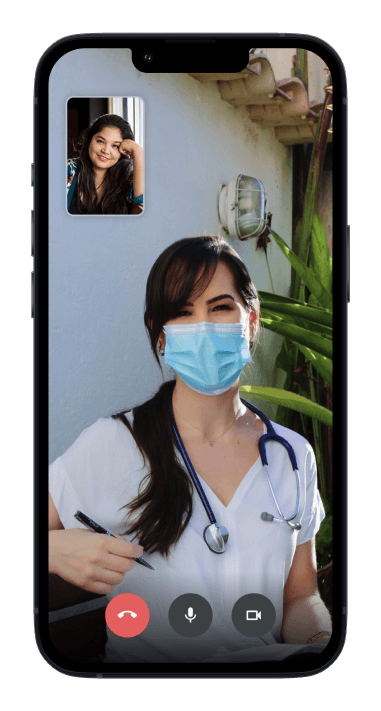

Digital-First Customer Experience

Instant onboarding, live chat, and smart notifications drive loyalty.

API-Ready for Growth

Easily connect with partners, apps, and fintechs—futureproofing your business.

Banking & Payments Excellence

Offer full-featured digital banking, instant payments, and account management—across mobile, web, and branch.

Upgrade Your Finance Platform

Lending, Wealth & Analytics

Automate loan origination, wealth management, and reporting—all in one platform.

Smarter Decisions, Better Outcomes

How We Build Finance Platforms for Spain

Discovery & Compliance Analysis

Workshops with Spainian finance leaders to map CBE, integration, and user experience needs—ensuring everything fits local law.

Payments, Lending & Open Banking

Development of real-time payments, loan origination, and Open Banking modules for flexible, accessible finance.

Security-First Development

Penetration testing and encrypted data lakes ensure trust and resilience for Spain customers.

Automated Reporting

Generate compliance reports for CBE and tax authorities with a click.

Customer Rollout & Integrations

Rapid deployment with integration to local payment rails, banks, and credit bureaus.

Continuous Upgrades & Support

Banao delivers updates for new standards, threats, and trends—keeping you ahead in Spain’s finance market.

Spain Fintech Success

Mona El Gamal

COO, Alexandria Bank

Yasser Morsi

Founder, FintechCairo

Compliance peace of mind!

Banao’s automation and support made our digital transformation smooth and audit stress-free.

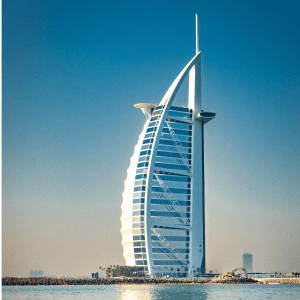

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently Asked Questions

What’s special about finance in Spain?

Local compliance, Open Banking, and customer protection are essential—our platforms are built for Spain’s unique needs.

Do you support digital wallets?

Yes—Apple Pay, Fawry, Meeza, and all local options are integrated.

Can you automate regulatory reporting?

Absolutely—save time and reduce errors with automated, audit-ready tools.

Is ongoing support available?

Yes—our Spain-based team provides updates, patches, and urgent support.