Business Data France Decide Better, Act Faster

Banao transforms raw data into powerful insights for French businesses—enabling faster decisions, optimized management, and sustainable growth.

Why Data for French Businesses?

Our solutions are designed for French specifics: tax reporting, GDPR, multilingual, and local tool integration. Data is the key to competitiveness in France: track your KPIs, anticipate the market, and manage your business with agility.

Security, Automation & GDPR Compliance

100% secure platforms, automated tax reporting, and GDPR compliance for your business data in France.

Access Management & Logs

Control who accesses what, with full traceability for audits.

ERP/CRM/eCommerce Integration

Centralize all your data for a 360° business view.

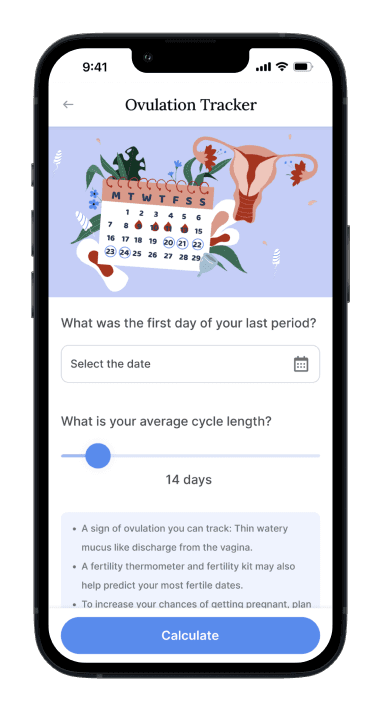

Mobile Dashboards

Monitor your key indicators on smartphone, tablet, or PC.

Automated Tax Exports

Generate FEC files, tax returns, and reports for your accountant.

Regulatory Updates

Platform always compliant, even as French law evolves.

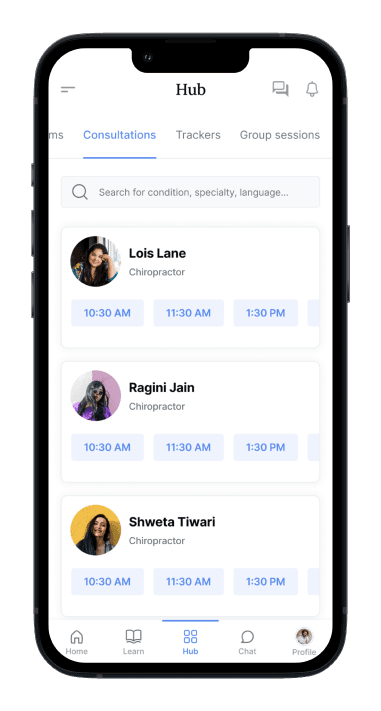

Monitor Everything, Analyze Better

Data & Analytics for French Businesses

Alerts & Proactive Decisions

Receive real-time alerts, anticipate risks, and seize opportunities.

Global & Departmental View

Finance, sales, HR, logistics: a dashboard for every challenge in your business.

Custom Dashboards & KPIs

Create your own indicators, visualize performance, and share results with your teams in real time.

Become a Data-Driven Company

Compliance, Tax & Audit

Generate audit-ready, tax, and regulatory reports for French law.

Compliance Without Stress

Our Process for Business Data in France

KPI Workshops & Data Mapping

Define key indicators, identify data sources (ERP, eCommerce, accounting), and map business needs for French operations.

Multi-Source Integration & Cleansing

Connect all your tools (ERP, CRM, Excel, SaaS), clean, validate, and centralize data for total reliability.

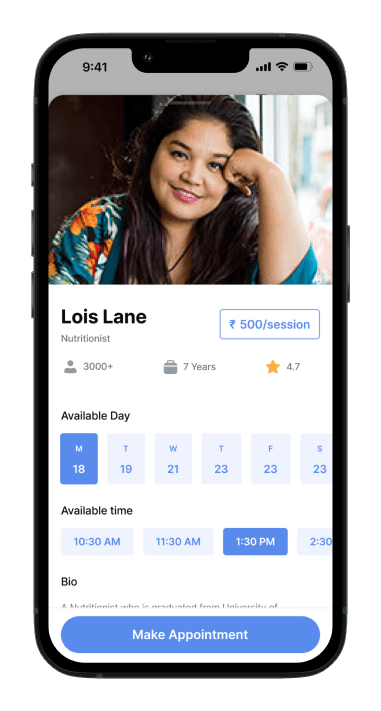

Custom Dashboards & Reporting

Design interactive dashboards for management, finance, HR, or sales—tailored for French business leadership.

Security, GDPR & Tax Compliance

Encrypted storage, access management, GDPR compliance, and automatic generation of tax and audit reports for France.

Deployment, Training & Support

Phased rollout, team training in French, and local technical support.

Continuous Optimization

Usage analysis, adding new indicators, and ongoing adaptation to regulatory and business changes in France.

Business Data Success Stories France

Julie Morel

CFO, Groupe SudOuest

Yassine Giraud

COO, StartUp Paris

Real-time indicators, faster decisions

Our dashboards are accessible everywhere and tax reporting is automated. Banao knows the French market perfectly.

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently Asked Questions

What’s unique about BI in France?

GDPR compliance, French tax law, multilingual, and integration with French ERP, SaaS, eCommerce tools.

Implementation timeline?

On average 4–8 weeks depending on complexity and number of data sources.

Multi-business or franchise support?

Yes, multi-entity, multi-country management and consolidated reporting included.

Is local support and training included?

Technical support and training are provided from France, in French.