Mumbai Finance Secure Digital Finance Solutions

Banao empowers Mumbai’s banks, fintechs, and financial businesses with secure, compliant, and customer-friendly digital platforms for payments, banking, lending, and analytics.

Advance Mumbai’s Finance Sector with Digital Innovation.

Banao’s solutions help you modernize core banking, launch new fintech products, and deliver seamless digital experiences for customers and partners in Mumbai. Our finance platforms offer secure payments, KYC, AML, and analytics—supporting Mumbai financial institutions and fintechs to serve the India market with confidence.

Finance Platform Compliance & Security in Mumbai.

Banao ensures your finance platform meets India Central Bank, PCI DSS, and global data privacy standards—protecting transactions, user data, and compliance.

PCI DSS Payment & Card Security

We provide secure, PCI DSS-compliant card processing and payment integration for Mumbai’s finance sector.

KYC & AML Compliance

Integrate robust KYC (Know Your Customer) and AML (Anti-Money Laundering) modules to meet India regulations.

Secure Payment Gateway Integration

Connect with leading India payment gateways for card, wallet, and bank transfer transactions.

GDPR & India Data Privacy

Protect sensitive financial data with privacy-by-design, encryption, and regulatory compliance.

Real-Time Fraud Monitoring

Deploy AI-powered fraud detection and transaction monitoring for secure finance operations.

Continuous Compliance Updates

Stay ahead of regulatory changes with proactive compliance monitoring and reporting.

Transform Mumbai Finance with Digital Banking & Fintech

Empowering India Financial Services

Finance Tech Innovation in Mumbai

From digital wallets to analytics and compliance, Banao is your partner for secure, modern finance solutions in the India.

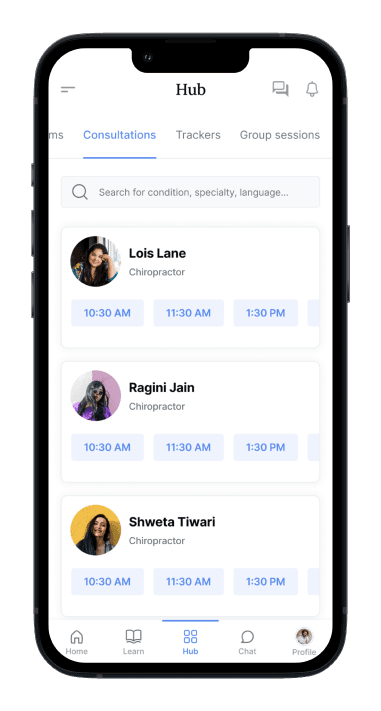

End-to-End Digital Finance Services

We support Mumbai finance institutions with strategy, development, integration, and ongoing compliance support.

Digital Payments & Banking Excellence

Offer secure payments, digital banking, and lending with real-time analytics and compliance for Mumbai’s finance sector.

Start Your Finance Digital Transformation in Mumbai

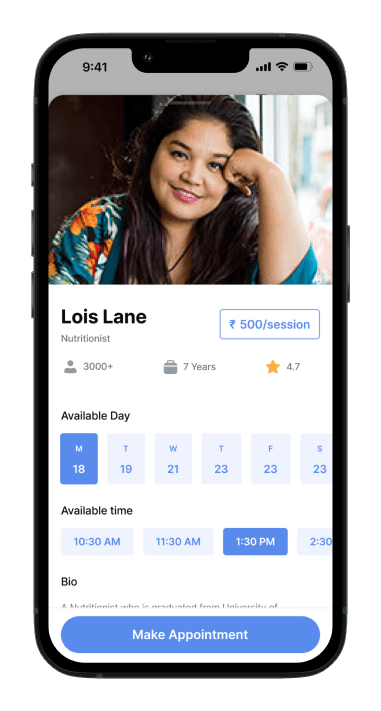

Compliance & Customer Experience in Finance

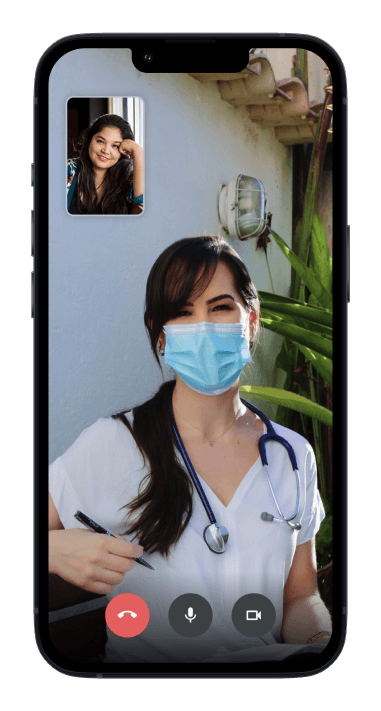

Deliver trusted, fast, and compliant digital finance journeys for India customers with seamless onboarding, support, and reporting.

Delight Finance Customers Across Mumbai

Finance Platform Development in Mumbai

Finance Discovery & Regulatory Planning

We analyze your financial institution’s requirements, compliance needs, and customer journeys—designing a secure platform for Mumbai’s finance sector.

Payments, Banking & Analytics Integration

We build and integrate secure payments, digital banking, lending, and analytics modules for seamless finance operations in the India.

Finance Platform QA & Security Testing

Banao’s QA team ensures robust security, reliable transactions, and compliance with India and global finance standards.

Financial Data Security & Compliance

We protect financial data with encryption, fraud prevention, and compliance with India Central Bank, PCI DSS, and GDPR standards.

Finance Platform Deployment & Integration

We launch your solution with payment, KYC, AML, and analytics integrations—delivering a seamless experience to Mumbai finance customers.

24/7 Finance Support & Compliance Updates

Enjoy proactive support, compliance updates, and new features to keep your finance platform secure and competitive in the India.

Looks what client say about us...

Jabez Zinabu

CEO, LeapifyTalk

RaviKant

CEO and Co-founder, Happimynd

Their diligence and punctuality is enviable!

Banao did a fantastic job in every way. They helped revamp the UI of our website as per our expectations. They were always on schedule when it came to delivering. We're not sure how they accomplish it, but the results are stunning. Their responsiveness and customer service are exceptional, and they are really appreciated.

Where we're located

Let's Build Something Great Together. 🤝

Here is what you will get for submitting your contact details.

45 minutes of free consultation

A strict non-disclosure agreement

Free market & competitive analysis

Suggestions on revenue models & planning

Detailed feature list document

No obligation proposal

Action plan to kick start your project

Frequently Asked Questions

What makes finance app development unique in Mumbai?

Mumbai finance platforms must be secure, scalable, AML/KYC compliant, and support Arabic/English, payments, and analytics.

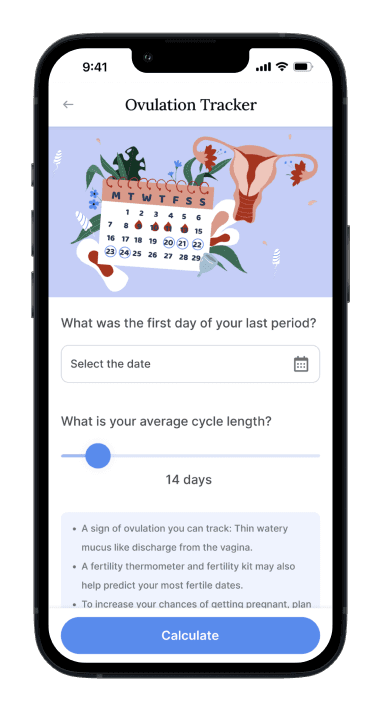

Do you support digital wallets and mobile banking?

Yes. We develop digital wallets, mobile banking, and payment integrations for Mumbai finance clients.

How do you ensure data and payment security?

By using PCI DSS, encryption, fraud detection, and ongoing compliance with India and global standards.

How long does it take to launch a finance platform?

Most projects take 3-6 months for core digital banking and fintech, with full compliance and integrations.